HMRC’s VAT Deferral New Payment Scheme opens for businesses who deferred VAT last year due to Coronavirus.

If you deferred VAT payments between 20th March and 30th June 2020, they are due by 31st March 2021. However, if you join the VAT Deferral New Payment Scheme, you can spread payments over a longer period.

The online portal for the new scheme opened today, here are some things you’ll need to know about signing up and what you need to do.

Why businesses deferred VAT in 2020

In 2020, the UK Government provided support to VAT registered businesses by allowing them to defer payment of VAT during the first lockdown. This Government support helped businesses with cashflow, at a time when many experienced an abrupt drop in income.

HMRC estimates that over half a million businesses took the opportunity to defer VAT payments during the first lockdown of the Coronavirus pandemic.

What is the VAT Deferral New Payment Scheme?

The scheme allows businesses to split their deferred VAT payments over up to 11 interest-free instalments. You can also choose to make fewer payments if preferred.

This approach helps manage cash flow by spreading payments beyond the 31st March 2021 deadline.

Businesses will need to opt-in to the VAT Deferral New Payment Scheme and have from 23rd February to 21st June 2021 to do so.

Signing up to the VAT Deferral New Payment Scheme

In order to sign up to the online scheme you will need to have a VAT online account (unfortunately you cannot ask an agent to use their login and help you do this). You must also be up-to-date with your VAT returns, and you must be able to pay by Direct Debit (there is an alternative entry route available if you cannot use Direct Debit, this is done by telephone with HMRC).

The sign-up process is straightforward. You will need to go to the gov.uk website and look for the green ‘join the scheme now’ button, about halfway down the page.

You’ll then be able to log in with your Government Gateway user ID and password. You will also need to use either an authenticator app, or a code sent to you via text, depending on how the security details are set up for your account.

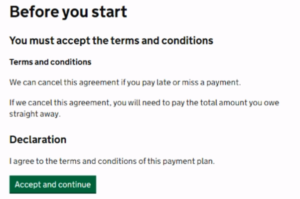

You will then be asked to accept the terms and conditions, but there are only a couple to read, and they are very standard. Basically, if you miss one of your Direct Debit payments, HMRC have the right to recall the debt, and so the remaining deferred VAT would fall due. It doesn’t state this, but presumably if you were unable to pay that in full they would then charge penalties and interest on the overdue amount.

The next screen confirms the amount of deferred VAT you have due. It also notes any payments you’ve made to date that have been offset against this, giving you the total deferred VAT due to be paid by 31st March 2022.

There is a link for what to do if the amount doesn’t match your records, but assuming it does, you’re then taken to a screen asking you how many instalments you’d like to pay over. It defaults to the total number available, but you can choose to pay in fewer instalments.

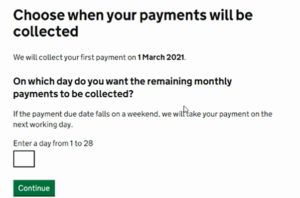

Next you can choose the date you would like your payments to be collected. If you sign up in February then the first payment will be 1st March, but you can choose anything from 1st-28th for your remaining payments.

You will then be given a summary of your payment plan, detailing the amount due each month until your plan ends.

Next you’re asked to set up the Direct Debit payments, and you are given the option to do this from a business bank account, or a personal bank account.

Once you’ve entered your bank details (name on account, sort code and account number) and confirmed the Direct Debit mandate, you’re done!