With over 2 million subscribers since it launched, Xero was built with small businesses in mind.

There are many benefits to using Xero, but here’s 5 that we think are particularly useful to small businesses.

What are the benefits of using Xero for small business owners?

Accounting software, VAT calculations, tax returns; most business owners don’t build a business so that they can focus solely on the financial aspects (except for us, we’re the exception), and bookkeeping can feel incredibly daunting when you’re first starting out.

With Xero, everyday financial tasks are simplified so that business owners, accountants and bookkeepers can seamlessly share real-time data, giving you everything you need to run your business effectively and efficiently.

5 Xero features for small businesses

1) Xero add-ons for a tailored experience

Xero offers a marketplace with over 800 add-on solutions to customize your experience for your industry. You can choose the tools you need and skip the rest. As your business grows, you can return to the marketplace and add more solutions anytime.

One of our favourites at Portt & Co is Dext Prepare (formerly Receipt Bank). This add-on helps collect and store essential paperwork, including receipts, invoices, and bank statements.

With Dext Prepare, you’ll never need to search for receipts or manually input them again. Simply snap a photo of the receipt with your smartphone. The add-on will extract the key data and integrate it with Xero, ready for your bookkeeper or management accountant to process.

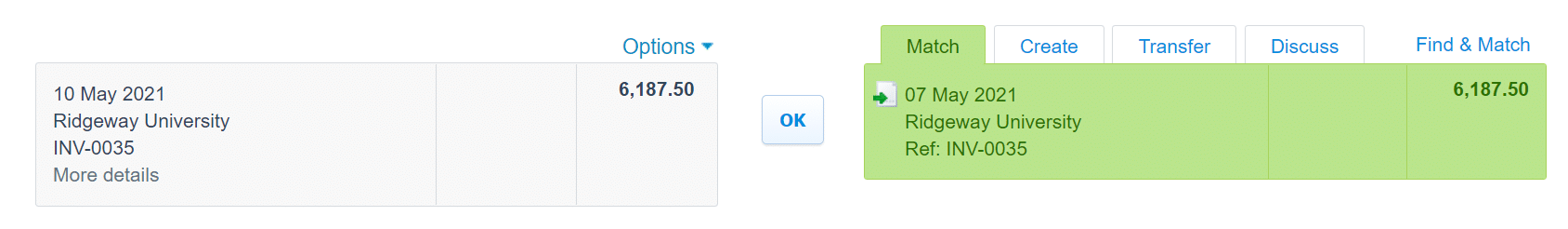

2) Easy-to-use reconciliation with Xero

By inputting everything through Xero, frustrating bank reconciliation is a thing of the past.

It’s important to reconcile your bank regularly so that you can find and resolve any problems as quickly as possible and stay on track of your finances.

With Xero’s reconciliation tool, you can review and match transactions daily using their automated suggested matches. You can also set your own rules and group similar transactions to reconcile at once.

Bank reconciliation comes as part and parcel of running a business, which is why Xero has made this feature as user-friendly as possible. Once your bank is connected, the data flows in automatically, and you can reconcile with the click of a button.

Xero Bank Reconciliation

3) A clear insight into your finances with the tap of a button

Knowing how much money is in your bank account is great, but it’s a little pointless if you don’t know what these numbers actually mean for your business.

The Xero account watchlist is one of the key features of your dashboard, displaying both the month and year-to-date balance of your small business accounts. You can break this down even further to your sales accounts, office expenses accounts and more, giving you in-depth and valuable information as soon as you log in.

Your accountant can also use this information to ascertain any areas of your business that need to be closely monitored. It allows you to make strategic decisions that will help your company thrive.

Xero Account Watchlist

4) Take your accounts with you via Xero cloud accounting

Over 2 million people across the world have subscribed to Xero. It helps their business work smarter and faster with cloud accounting technology.

Cloud accounting simply means that your ‘books’ are stored online. With your data being stored on the cloud, this means you can access it anytime, anywhere. As long as you have a device with internet connection, allowing for flexible, on-the-go working.

You can also check whether invoices have been paid and upload photographs of business-related receipts at any time of the day, from any location.

The data is encrypted so that only users with the log-in details can access it, making it very easy to work closely with your accountant and bookkeeper.

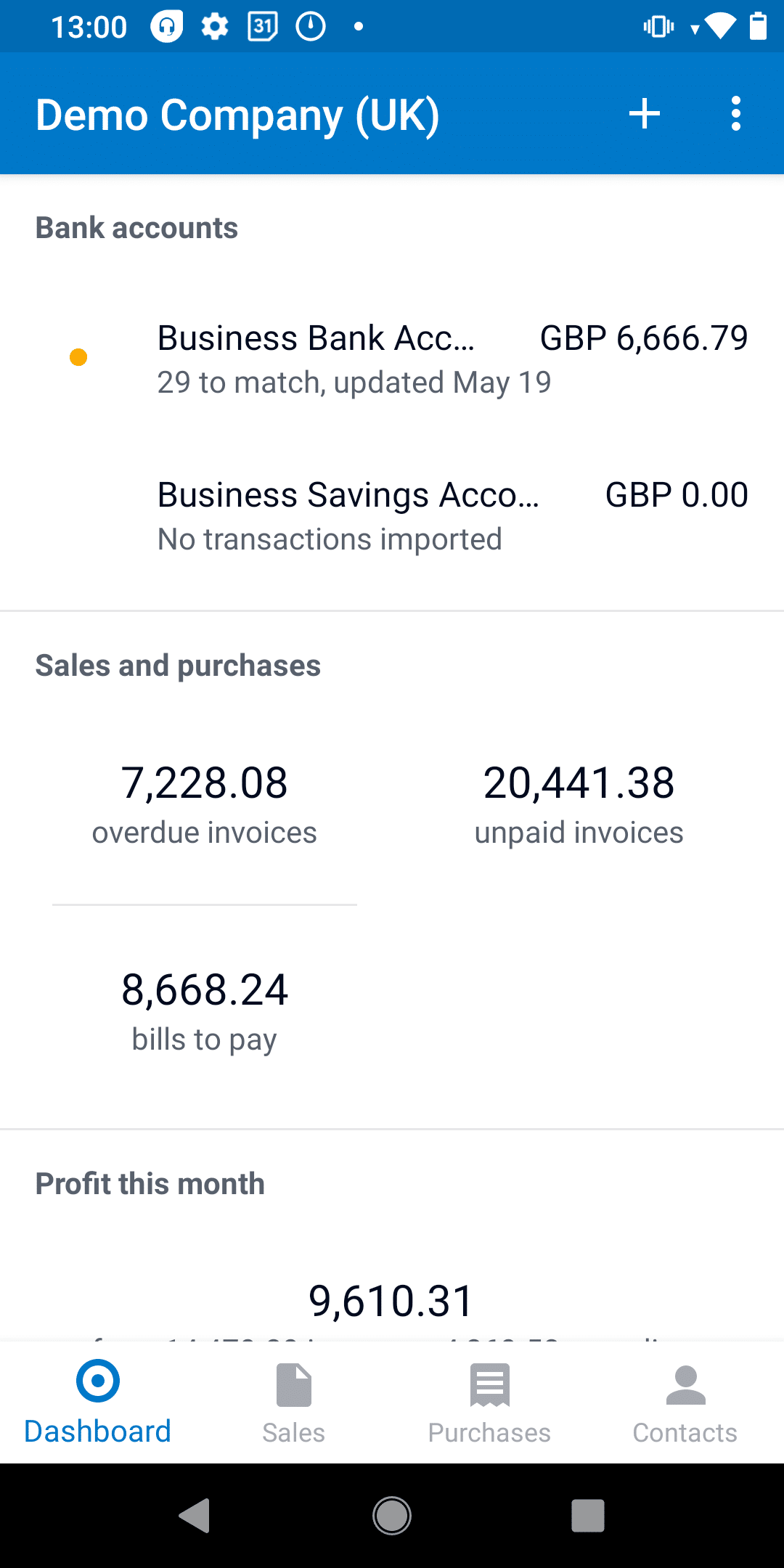

5) Access Xero using your mobile phone

It’s estimated that 3.6 billion people worldwide have a smartphone. That’s why it’s so essential for Xero to make your everyday business tools as accessible as possible.

You can download the Xero app on iOS and Android, meaning that wherever you are, you can

- Send invoices

- Monitor your accounts

- Reconcile transactions

- Access financial reports

- Automate CIS calculations

Xero mobile app

Get started with Xero accounting software for small businesses

At Portt & Co, we offer a range of expert services to help you make the most of your business. We are proud Xero gold champion partners and have been rated as specialists for Xero migration and Making Tax Digital Ready.

If you would like to learn more about Xero and how we can help you manage your small business finances, please get in touch.